By Paul Davis

It’s time to shop for your Medicare supplement plan. How do you do this, what do you need to know and how much time will it take? The answer is simple. You don’t have to do anything, we do it for you.

What are Medicare Supplement Plans? Insurance that allows you to see any Medicare contracted provider in the U.S. without a referral. We regularly save people more than $1000 a year on their Medicare supplement plans. If you’re like many people, you may have signed up for a plan 10, 15 or even 20 years ago and have never bothered to shop for a better deal, or what I like to call “a reality check.”

How much money are you wasting on plans that don’t suit your needs?

If you’re lucky enough to have gotten on a Plan J or I, which has not been sold since 2010, you are on the most robust standardized Medicare supplement plan that ever existed. Plan J and I have an at-home recovery benefit that does not exist on current plans. We had hundreds of clients on this plan but not one that ever used this benefit. How much extra are you paying annually for this benefit, and is it worth it?

That’s where we come in. Here’s a brief explanation of the plans.

Since 2010, Plan F has replaced Plan J and I as the most robust plan available. It is still available to those who turned 65 before Jan. 1, 2020. But if your 65th birthday or Medicare eligibility is after that date, you are not eligible for this plan. There are no new young 65 year olds enrolling to dilute the pools. Consequently, we have seen significant price hikes on Plan F.

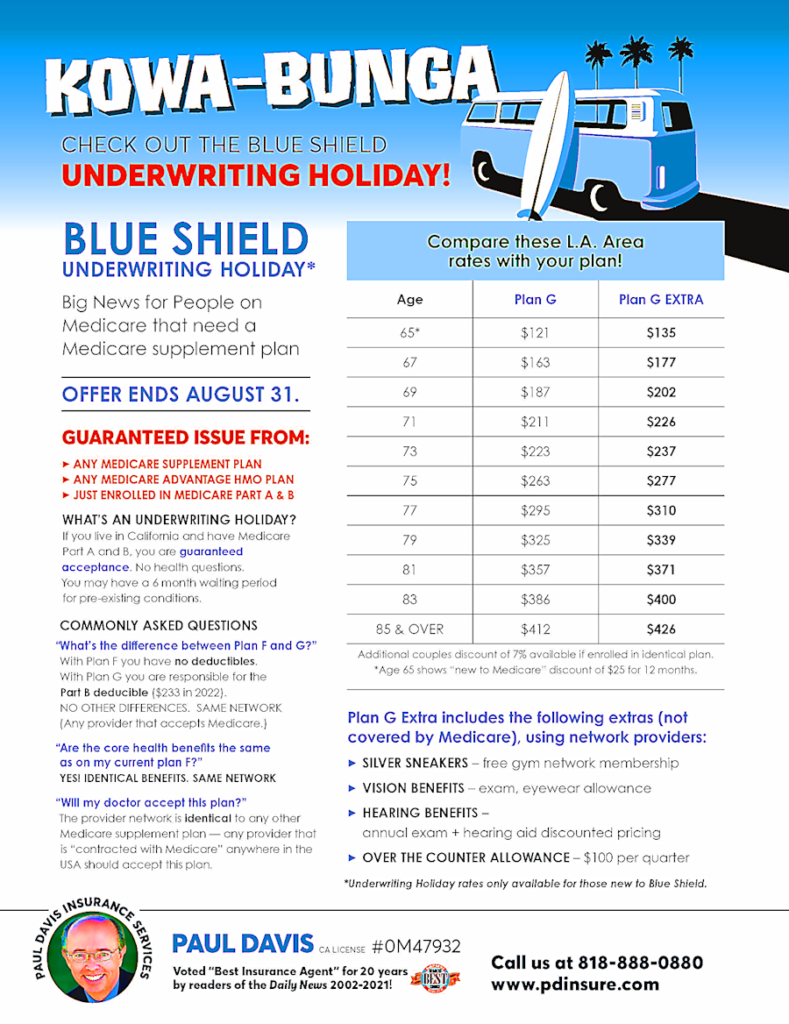

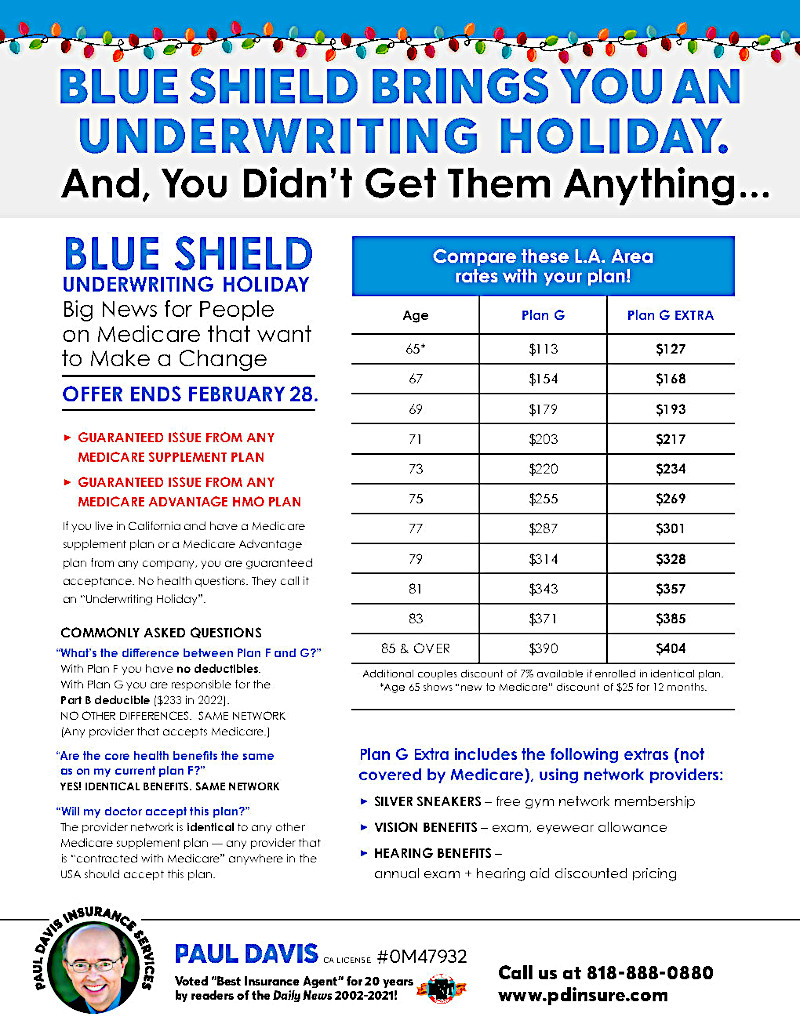

Plan G is the one we are moving our clients to. The only difference between Plans F and G is that with G you are responsible for the Part B deductible. That one-time deductible is $233 this year and will index up annually. If we save someone $100/mo. in their premium and they need to absorb this deductible, they are ahead by almost $1000. Over the past few years, we have seen more companies emerge with Plan G offerings and offer competitive pricing on them.

All the plans mentioned use the EXACT SAME NETWORK of providers and pay the exact same benefits (other than the deductible and recovery benefit).

For a Los Angeles County reality price check, go to https://pdinsure.com/medicare-supplement-price.

In California, we have a “birthday rule” which guarantees the right of existing Medicare supplement plan subscribers to change to any carrier’s similar or lesser Medicare supplement plan within 60 days of their birthday — with no health questions.

Now through February 28, both Blue Shield of California and AARP/UHC have open enrollments going. You can transfer to these carriers Medicare supplement plans from any present plan with NO HEALTH QUESTIONS.

Paul Davis of Paul Davis Insurance Services is an independent insurance agent licensed for more than 37 years, CA license 0669770, 0M47932, with a focus on Medicare plans for more than 12 years. Paul was recently appointed to the National Association of Health Underwriters Medicare Advisory Group. His practice is entirely devoted to this market segment. More information is available at https://pdinsure.com/, or contact Paul at 818-888-0880 or via email paul@pdinsure.com.