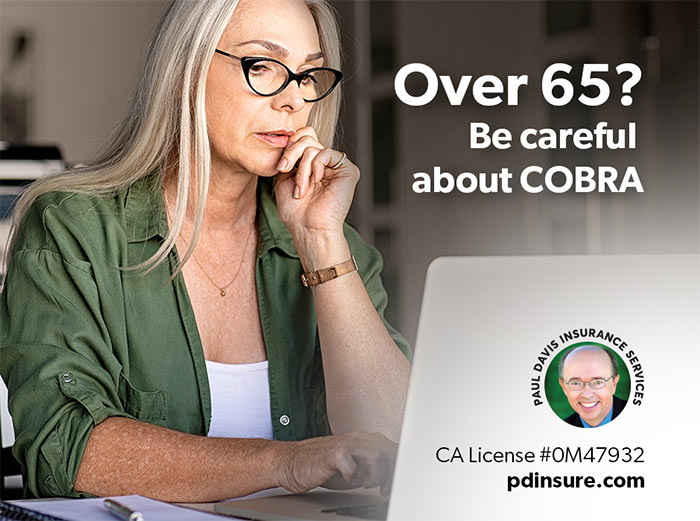

Lately, we have seen a lot of people over 65 being terminated, losing group health insurance, and transitioning onto COBRA.

Is your employer offering to pay for several months of COBRA? Be careful as this may give you a false sense of security. Even though your employer is paying for COBRA you may find that your claims are being denied by the insurance carrier when your explanation of benefits arrives. You do not want a large medical bill when you can least afford to pay it. Most employers and HR departments are not aware of this exclusion of benefits under COBRA and are providing no guidance. This change should involve an exploration of Medicare and Medicare health plan options.

There is a potential problem if you do not also sign up for Medicare Parts A and B when you are over 65 and enroll in COBRA. This article was precipitated by a call from a woman experiencing this problem. I have also had a call from an attorney trying to help one of his clients with this same issue.

COBRA stands for Consolidated Omnibus Budget Reconciliation Act of 1983. It was designed to extend group health benefits for 18 months (sometimes more) for someone losing group health coverage. In California we also have CAL-COBRA which covers employers with fewer than 20 employees and can extend benefits for up to 36 months. You can continue the same coverage after termination under COBRA/CAL-COBRA, but you will pay the full amount of the premiums plus a 2% or 10% service charge.

If your employer has a group plan with 20 or more employees, that plan generally is considered the primary payor and Medicare can be the secondary payor (if you have enrolled in that coverage). We usually suggest that people turning 65 should probably enroll in Part A even if they have a company group policy, because Part A has no cost for most workers (consult with your HR dept.).

There is an issue as to whether people on a group plan with 20 or more employees should enroll in Part B, since the cost is at least $144.60/mo. There is likely no benefit to Part B enrollment if you are employed. We also tell people that are contributing to an H.S.A. account to not enroll in any part of Medicare.

If you are over 65 and you get terminated from your employment everything changes. You are no longer part of a group plan and Medicare becomes primary and your COBRA plan is secondary. So, if you have not already enrolled in Medicare Part A and B you can have a potential claims nightmare.

After termination, your medical claims will be submitted to Medicare, as they are the primary payor. What? You did not sign up for Medicare? Well, you will find out that COBRA will deny payment for any claim that Medicare would have paid if you had signed up for Part A and Part B – which generally is everything. Medicare is not obligated to pay, since you did not sign up for it. Who ends up paying the bill? You.

Some clients have been given verbal assurances by the HR Department of their employer that they do not need to enroll in Medicare, since COBRA will continue to pay as before. This is bad advice. If you do not get that guaranteed in writing from the COBRA carrier, do not believe it. That is not going to happen.

One other potential issue for someone over 65 who enrolls in COBRA: If you delay enrollment in Medicare you could potentially end up with a late enrollment penalty for Part B or D. You may also have timing issues with implementation. Enrolling at actual loss of the group plan is generally more advantageous.

If you are 65+ and on a group of less than 20 employees, you should enroll in Parts A and B unless the group contract specifically states that you are fully covered without being on Medicare.

Confused? We get it. Medicare causes confusion in almost everyone we talk to. That is why we only work on helping people that are Medicare eligible to figure this stuff out. Paul Davis, Paul Davis Insurance Services 818 888 0880 pdinsure.com

CA license OM47932

See PDF of original article by Paul Davis in Valley Vantage.